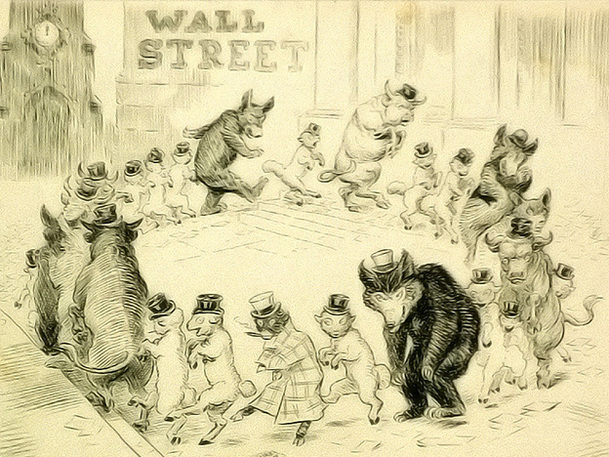

Wall Street Zoology

John Maynard Keynes employed the term "Animal Spirits" to describe less than rational behavior in financial markets. In the wake of the 2008-2009 credit crisis, Robert Shiller, a professor of financial economics at Yale, and George Akerlof, a professor of economics at U.C. Berkeley, return to Keynes's thoughts on bestial behaviors in global finance in their book published in 2009. On a popular level, the representation of market traders as creatures enjoys a rich history and a developed lexicon.

BEARS AND BULLS

The most common distinction in contemporary times is, of course, that of the classic bulls and bears. Bulls are confident of asset price rises, while bears are certain of falls. Jesse Livermore, a legendary "stock operator" in the early 1900s famously declared: "Bulls make money, bears make money, but pigs get slaughtered..."

An animated representation of these furry combatants is given by the market information/advisory service Minyanville. The bull, "Hoofy", is a designer suit-wearing corporate man, while the bear, "Boo", is a tie-dye wearing hippie.

While bovine bulls feed on grass, market bulls feed on the supply of money. However, cheap money as enabled by central banks is often represented as something of an addiction rather than a daily staple. In this cartoon by the Economist, Federal Reserve chairman Ben Bernanke is seen giving the poor bull another dose.

DOVES, HAWKS, LIONS, ETC...

A colorful recent article by NPR, summarizes the thoughts of Charles R. Geisst, a professor of finance at Manhattan College, who gives us other common zoological taxonomies of the "Street".

Hawks and doves refer to those with and without fears of future inflation. The hawks favor higher interest rates to counter the perceived inflationary threat, while doves believe lower rates are appropriate.

CEOs of top investment banks are characterized as lions. Hear them roar....

Sheep, surprisingly, are not the ignorant masses, but fund mangers who, out of fear, follow too closely to index benchmarks such as the S&P 500. For more beasts of money, please check out the article.

One notable omission in the article is that of the squid. I have seen this term pop up more and more frequently in financial blogs and media to describe the most competitive (cutthroat) of traders and hedge fund managers.

Hawks and doves refer to those with and without fears of future inflation. The hawks favor higher interest rates to counter the perceived inflationary threat, while doves believe lower rates are appropriate.

CEOs of top investment banks are characterized as lions. Hear them roar....

Sheep, surprisingly, are not the ignorant masses, but fund mangers who, out of fear, follow too closely to index benchmarks such as the S&P 500. For more beasts of money, please check out the article.

One notable omission in the article is that of the squid. I have seen this term pop up more and more frequently in financial blogs and media to describe the most competitive (cutthroat) of traders and hedge fund managers.

FEAR THE BLUE DEMON?

In August of 2011, a new creature has struck fear into the hearts of market participants: none other than the stumpy blue Smurf. A contingent of Smurfs rang the opening bell at the New York Stock Exchange inopportunely before a series of violent market crashes.

The fallout is best shown with this candlestick chart of the S&P 500.

Outside of these "blue meanies", what other creatures lie in wait either to bring us to early retirement or lay waste to our 401ks and IRAs???

Modern market participants can only put their faith in the undying enthusiasm of the new denizen of financial blogs: the dear Rally Monkey.